Welcome to Engage™, Lake County's citizen engagement portal!

A modern approach to citizen engagement suggests that some citizens appreciate the ability to interact with their local government in a digital environment, such as online access to services to; pay property taxes, research publicly available information, submit documents and forms, etc. That’s where Engage™ comes in!

Engage™ is intended to be an intuitive, user-friendly application. However, we know that some features of Engage™ could use a bit of guidance to be completely beneficial to you. This informative guide will serve to provide you with a bit more guidance, should you have a need. As well to the left, we are happy to provide you with a number of resources to assist you in your property assessment journey.

Thank you for visiting our website and for the opportunity to serve you and your needs.

Please contact us anytime - we are here to help!

News

Revised Indiana Sales Disclosure Form (SDF)

The Indiana Department of Local Government Finance (DLGF) has revised the Sales Disclosure Form (State Form 46021), effective January 1, 2021. Please contact our office at (219) 755-3100 or Assessor@lakecountyin.org if you have any further questions. You may also visit the Department’s website to access the new forms or for more information at https://www.in.gov/dlgf/8294.htm.

Online Door Hanger

For Pre-populated Form:

- From the Home page, enter your provided parcel number or address.

- Select your property from the parcel list.

- Once the Parcel Detail panel opens, select the Forms tab.

- To complete the form, click the Online Door Hanger link.

- Fill out the form, in its entirety, and then click submit.*

For Blank Form:

- From the Home page, click the Resources button at the top of the page.

- Click Forms, on the left side column.

- To complete the form, click the Online Door Hanger link.

- Fill out the form, in its entirety, and then click submit.*

Personal Property Online Portal – Indiana (PPOP-IN)

The Indiana Department of Local Government Finance (DLGF) has a new online service portal to file business personal property filings! This system will be available in January 2021. Please contact our office at (219) 755-3100 or Assessor@lakecountyin.org if you have any further questions. You may also visit the Department’s website for more information at https://www.in.gov/dlgf/7576.htm.

Attention Leasing Companies

Per 50 Ind. Admin. Code 4.2-2-9, if a taxpayer claims any adjustment on the value of his property, a Form 106 must be filed. In lieu of using the actual return form prescribed , a taxpayer may use a computer or machine prepared substitute tax return form or schedule if that substitute:

(1) contains all of the information as set forth in the prescribed form; and

(2) properly identifies the form or schedule being substituted.

Form 106Personal Property Online Portal – Indiana (PPOP-IN)

The Indiana Department of Local Government Finance (DLGF) has a new online service portal to file business personal property filings! This system will be available in January 2021. Please contact our office at (219) 755-3100 or Assessor@lakecountyin.org if you have any further questions. You may also visit the Department’s website for more information at https://www.in.gov/dlgf/7576.htm.

Attention Leasing Companies

Per 50 Ind. Admin. Code 4.2-2-9, if a taxpayer claims any adjustment on the value of his property, a Form 106 must be filed. In lieu of using the actual return form prescribed , a taxpayer may use a computer or machine prepared substitute tax return form or schedule if that substitute:

(1) contains all of the information as set forth in the prescribed form; and

(2) properly identifies the form or schedule being substituted.

Form 106Online Door Hanger

For Pre-populated Form:

- From the Home page, enter your provided parcel number or address.

- Select your property from the parcel list.

- Once the Parcel Detail panel opens, select the Forms tab.

- To complete the form, click the Online Door Hanger link.

- Fill out the form, in its entirety, and then click submit.*

For Blank Form:

- From the Home page, click the Resources button at the top of the page.

- Click Forms, on the left side column.

- To complete the form, click the Online Door Hanger link.

- Fill out the form, in its entirety, and then click submit.*

News

Revised Indiana Sales Disclosure Form (SDF)

The Indiana Department of Local Government Finance (DLGF) has revised the Sales Disclosure Form (State Form 46021), effective January 1, 2021. Please contact our office at (219) 755-3100 or Assessor@lakecountyin.org if you have any further questions. You may also visit the Department’s website to access the new forms or for more information at https://www.in.gov/dlgf/8294.htm.

Welcome to Engage™, Lake County's citizen engagement portal!

A modern approach to citizen engagement suggests that some citizens appreciate the ability to interact with their local government in a digital environment, such as online access to services to; pay property taxes, research publicly available information, submit documents and forms, etc. That’s where Engage™ comes in!

Engage™ is intended to be an intuitive, user-friendly application. However, we know that some features of Engage™ could use a bit of guidance to be completely beneficial to you. This informative guide will serve to provide you with a bit more guidance, should you have a need. As well to the left, we are happy to provide you with a number of resources to assist you in your property assessment journey.

Thank you for visiting our website and for the opportunity to serve you and your needs.

Please contact us anytime - we are here to help!

Public Service Announcements

Videos

Announcements

Public Service Announcements

Videos

Announcements

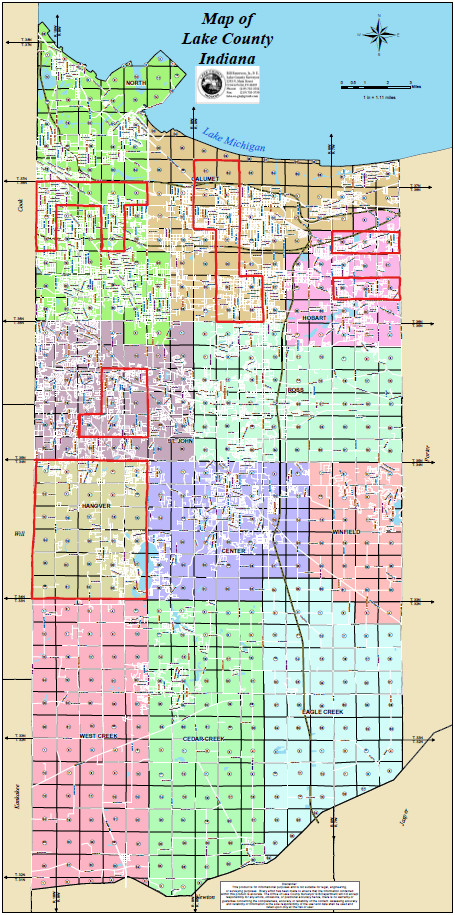

Cyclical Reassessment

During statewide reassessments, county and township assessors physically inspect each property to ensure that records are correct. Approximately 25% of the parcels in each jurisdiction will be reassessed each year, over a four-year time frame.During a field inspection, personnel will attempt to make contact with the taxpayer to identify his/herself and explain their purpose for the visit. They will ask several questions to verify information about the interior of the property and request permission to inspect the exterior. If no one is home, personnel will proceed with their work, which includes an inspection of the front and rear of the property. When the inspection is complete, a door hanger will be left to inform the taxpayer that we were there. Photographs will also be taken during all inspections.

Each reassessment field inspector wears an ID badge and an identifying t-shirt or vest. If a taxpayer is uncertain about the identity of a representative, please contact the Lake County Assessor's Office at 219-755-3100 for verification.

Refer to the map for an approximate time frame when you can expect personnel will be in your area. The areas in white will be inspected this year.

For re-inspection schedules in Township jurisdictions, contact your Township Assessor's office.

2025 reassessment will be conducted in the following areas under the County Assessor’s jurisdiction:

- Hammond

- Griffith

- West Creek

- Cedar Creek

Note: Lake County will not be issuing Form 11s for 25pay26; tax bills will serve as notice for all taxpayers.

Cyclical Reassessment

During statewide reassessments, county and township assessors physically inspect each property to ensure that records are correct. Approximately 25% of the parcels in each jurisdiction will be reassessed each year, over a four-year time frame.During a field inspection, personnel will attempt to make contact with the taxpayer to identify his/herself and explain their purpose for the visit. They will ask several questions to verify information about the interior of the property and request permission to inspect the exterior. If no one is home, personnel will proceed with their work, which includes an inspection of the front and rear of the property. When the inspection is complete, a door hanger will be left to inform the taxpayer that we were there. Photographs will also be taken during all inspections.

Each reassessment field inspector wears an ID badge and an identifying t-shirt or vest. If a taxpayer is uncertain about the identity of a representative, please contact the Lake County Assessor's Office at 219-755-3100 for verification.

Refer to the map for an approximate time frame when you can expect personnel will be in your area. The areas in white will be inspected this year.

For re-inspection schedules in Township jurisdictions, contact your Township Assessor's office.

2025 reassessment will be conducted in the following areas under the County Assessor’s jurisdiction:

- Hammond

- Griffith

- West Creek

- Cedar Creek

Note: Lake County will not be issuing Form 11s for 25pay26; tax bills will serve as notice for all taxpayers.

Appeals

IC 6-1.1-15-1.1

As a result of legislative changes that were passed in 2017, significant changes have been made to the appeal process.

Taxpayers wishing to contest their assessment must now do so on the State prescribed form, Form 130. Form 133, which

was previously used to contest assessments on objective grounds, has been eliminated. Taxpayers wishing to contest their

assessment on objective grounds (for example, a garage that has been removed or too much square footage) should now do

so using page 2 of Form 130. For further information, please visit the DLGF’s website at

http://www.in.gov/dlgf/ or contact our office directly.

The website has been updated to reflect 2024 assessed values (for taxes payable in 2025). The deadline to appeal is June 16th. Please feel free to contact us for additional information.

You may submit all appeal related documentation via email to assessor@lakecountyin.org

Appeals

IC 6-1.1-15-1.1

As a result of legislative changes that were passed in 2017, significant changes have been made to the appeal process.

Taxpayers wishing to contest their assessment must now do so on the State prescribed form, Form 130. Form 133, which

was previously used to contest assessments on objective grounds, has been eliminated. Taxpayers wishing to contest their

assessment on objective grounds (for example, a garage that has been removed or too much square footage) should now do

so using page 2 of Form 130. For further information, please visit the DLGF’s website at

http://www.in.gov/dlgf/ or contact our office directly.

The website has been updated to reflect 2024 assessed values (for taxes payable in 2025). The deadline to appeal is June 16th. Please feel free to contact us for additional information.

You may submit all appeal related documentation via email to assessor@lakecountyin.org

Property Tax Assessment Board of Appeals

Lake County has a 5 voting-member Board. The County Assessor serves as secretary and a non-voting member.Members

- Robin Salzeider - President

- Appointment: Board of Commissioners

- Term Expires: 12/31/2025

- David Wickland

- Appointment: Board of Commissioners

- Term Expires: 12/31/2025

- Warren Reeder

- Appointment: Board of Commissioners

- Term Expires: 12/31/2025

- Carly Brandenburgh - Vice President

- Appointment: County Council

- Term Expires: 12/31/2025

- Kenneth Barksdale

- Appointment: County Council

- Term Expires: 12/31/2025

- LaTonya Spearman - Secretary

- Statutory Non-voting Member

Meeting Information

Meetings are held in the Lake County Training & Media Center, Room A-099 and begin at 9:30am.

Property Tax Assessment Board of Appeals

Lake County has a 5 voting-member Board. The County Assessor serves as secretary and a non-voting member.Members

- Robin Salzeider - President

- Appointment: Board of Commissioners

- Term Expires: 12/31/2025

- David Wickland

- Appointment: Board of Commissioners

- Term Expires: 12/31/2025

- Warren Reeder

- Appointment: Board of Commissioners

- Term Expires: 12/31/2025

- Carly Brandenburgh - Vice President

- Appointment: County Council

- Term Expires: 12/31/2025

- Kenneth Barksdale

- Appointment: County Council

- Term Expires: 12/31/2025

- LaTonya Spearman - Secretary

- Statutory Non-voting Member

Meeting Information

Meetings are held in the Lake County Training & Media Center, Room A-099 and begin at 9:30am.

Personal Property

Personal Property is a self-assessed valuation system whereby property owners are responsible for reporting all tangible personal property that is used in their trade or business, used for the production of income, or held as an investment that should be or is subject to depreciation for federal income tax purposes. Completed personal property returns are due on or before Monday, May 16, 2022.A penalty of twenty-five dollars ($25) applies for returns filed after May 16th. For returns not filed within thirty (30) days of the due date, an additional fee of twenty percent (20%) of the taxes payable will be assessed.

Pursuant to Indiana Code 6-1.1-3-7 (b), a county assessor MAY grant an extension of not more than thirty (30) days to file the taxpayer's return.

Attention Leasing Companies

Per 50 Ind. Admin. Code 4.2-2-9, if a taxpayer claims any adjustment on the value of his property, a Form 106 must be filed. In lieu of using the actual return form prescribed , a taxpayer may use a computer or machine prepared substitute tax return form or schedule if that substitute:

(1) contains all of the information as set forth in the prescribed form; and

(2) properly identifies the form or schedule being substituted.

Personal Property Exemption

Personal Property exemption eligibility/notification SEA 233-2019

Beginning with the January 1, 2022 assessment date, the personal property exemption increases from $40,000 to $80,000. Personal property returns for eligible taxpayers (those whose total acquisition costs do not exceed $80,000) must include the following information:

- A declaration that the taxpayer's business property in the county is exempt from taxation;

- Whether the taxpayer's business personal property within the county is in one (1) location or multiple locations; and

- If the property is in multiple locations, the taxpayer must provide an address for the location where the sum of personal property acquisition costs is greatest.

New for Business Personal Property Tax Exemption for 2023

If the acquisition cost of all of your business personal property is less than $80,000 and you filed in 2022 you are NOT REQUIRED TO FILE FOR 2023. Churches and religious societies that have filed returns for five (5) years and who were exempt from taxes in those five (5) years no longer are required to file a return unless either of the following occurs:- There is a change in ownership

- There is any other change resulting in the personal property no longer being eligible for the exemption. See IC 6-1.1-3-7.3

AAMH FAQPlease contact our office at (219)755-3100 or assessor@lakecountyin.org if you have any questions. For more information, you may visit our website at https://assessor.lakecountyin.org and the DLGF’s website at https://www.in.gov/dlgf/7576.htm.

Forms

Form 102

Form 104

Form 106Personal Property

Personal Property is a self-assessed valuation system whereby property owners are responsible for reporting all tangible personal property that is used in their trade or business, used for the production of income, or held as an investment that should be or is subject to depreciation for federal income tax purposes. Completed personal property returns are due on or before Monday, May 16, 2022.A penalty of twenty-five dollars ($25) applies for returns filed after May 16th. For returns not filed within thirty (30) days of the due date, an additional fee of twenty percent (20%) of the taxes payable will be assessed.

Pursuant to Indiana Code 6-1.1-3-7 (b), a county assessor MAY grant an extension of not more than thirty (30) days to file the taxpayer's return.

Attention Leasing Companies

Per 50 Ind. Admin. Code 4.2-2-9, if a taxpayer claims any adjustment on the value of his property, a Form 106 must be filed. In lieu of using the actual return form prescribed , a taxpayer may use a computer or machine prepared substitute tax return form or schedule if that substitute:

(1) contains all of the information as set forth in the prescribed form; and

(2) properly identifies the form or schedule being substituted.

Personal Property Exemption

Personal Property exemption eligibility/notification SEA 233-2019

Beginning with the January 1, 2022 assessment date, the personal property exemption increases from $40,000 to $80,000. Personal property returns for eligible taxpayers (those whose total acquisition costs do not exceed $80,000) must include the following information:

- A declaration that the taxpayer's business property in the county is exempt from taxation;

- Whether the taxpayer's business personal property within the county is in one (1) location or multiple locations; and

- If the property is in multiple locations, the taxpayer must provide an address for the location where the sum of personal property acquisition costs is greatest.

New for Business Personal Property Tax Exemption for 2023

If the acquisition cost of all of your business personal property is less than $80,000 and you filed in 2022 you are NOT REQUIRED TO FILE FOR 2023. Churches and religious societies that have filed returns for five (5) years and who were exempt from taxes in those five (5) years no longer are required to file a return unless either of the following occurs:- There is a change in ownership

- There is any other change resulting in the personal property no longer being eligible for the exemption. See IC 6-1.1-3-7.3

AAMH FAQPlease contact our office at (219)755-3100 or assessor@lakecountyin.org if you have any questions. For more information, you may visit our website at https://assessor.lakecountyin.org and the DLGF’s website at https://www.in.gov/dlgf/7576.htm.

Forms

Form 102

Form 104

Form 106

Non-Profit

Indiana Code 6-1.1-10-16 describes the use and/or purpose necessary to become tax exempt. Charitable, educational, and religious organizations may be eligible for a tax exemption. An exemption must be timely filed or it will be deemed waived. Exemptions must be filed on or before April 1st of the tax year or of the pay year with the County Assessor.Non-Profit entities that meet the criteria for the less than $80,000 Personal Property Exemption are not required to file the certification. See the Personal Property tab.

Forms

Please Note: An exemption granted under IC 6-1.1-10 or any other statute supersedes this exemption. In other words, a taxpayer whose personal property is exempt because the taxpayer applied for and was granted an exemption by the county must follow all applicable procedures for the approved exemption, which may include fully completing the personal property return.

Non-Profit

Indiana Code 6-1.1-10-16 describes the use and/or purpose necessary to become tax exempt. Charitable, educational, and religious organizations may be eligible for a tax exemption. An exemption must be timely filed or it will be deemed waived. Exemptions must be filed on or before April 1st of the tax year or of the pay year with the County Assessor.Non-Profit entities that meet the criteria for the less than $80,000 Personal Property Exemption are not required to file the certification. See the Personal Property tab.

Forms

Please Note: An exemption granted under IC 6-1.1-10 or any other statute supersedes this exemption. In other words, a taxpayer whose personal property is exempt because the taxpayer applied for and was granted an exemption by the county must follow all applicable procedures for the approved exemption, which may include fully completing the personal property return.

Inheritance

Inheritance tax in the State of Indiana was repealed for individuals who died after Dec. 31, 2012. No inheritance tax returns have to be prepared or filed. No tax has to be paid. In addition, no Consents to Transfer personal property or Notice of Intended Transfer of Checking Account are required for those dying after Dec. 31, 2012. However, for individuals who died before January 1, 2013, inheritance tax returns are still required for those that exceed their exemption amount.Effective April 1, 2016, all resident Indiana Inheritance Tax Returns (Form IH-6) for individuals who died prior to January 1, 2013 must be filed with the Indiana Department of Revenue, rather than the county courts.

The Indiana Department of Revenue (DOR) Inheritance Tax Division works with individuals, tax professionals, assessors, attorneys, and financial institutions to understand what tax forms need to be prepared and filed and whether any inheritance tax is due. Note however, that due to the complexities of inheritance tax, taxpayers may want to consult with attorneys or accountants who are familiar with Indiana's inheritance tax to determine what forms, if any, should be prepared or filed.

For more information please visit the DOR's website at https://www.in.gov/dor/tax-forms/inheritance-tax-forms/. You may also contact DOR via email at inheritancetax@dor.in.gov or call at 317-232-2154.

Monday through Friday, 8 a.m. - 4:30 p.m., EST.

For more information regarding the repeal of inheritance tax, view the letter the Indiana Department of Revenue issued here, inheritance.pdf.

Indiana Department of Revenue

Re: Inheritance Tax Division

P.O. Box 71

Indianapolis, IN 46206-0071

Inheritance

Inheritance tax in the State of Indiana was repealed for individuals who died after Dec. 31, 2012. No inheritance tax returns have to be prepared or filed. No tax has to be paid. In addition, no Consents to Transfer personal property or Notice of Intended Transfer of Checking Account are required for those dying after Dec. 31, 2012. However, for individuals who died before January 1, 2013, inheritance tax returns are still required for those that exceed their exemption amount.Effective April 1, 2016, all resident Indiana Inheritance Tax Returns (Form IH-6) for individuals who died prior to January 1, 2013 must be filed with the Indiana Department of Revenue, rather than the county courts.

The Indiana Department of Revenue (DOR) Inheritance Tax Division works with individuals, tax professionals, assessors, attorneys, and financial institutions to understand what tax forms need to be prepared and filed and whether any inheritance tax is due. Note however, that due to the complexities of inheritance tax, taxpayers may want to consult with attorneys or accountants who are familiar with Indiana's inheritance tax to determine what forms, if any, should be prepared or filed.

For more information please visit the DOR's website at https://www.in.gov/dor/tax-forms/inheritance-tax-forms/. You may also contact DOR via email at inheritancetax@dor.in.gov or call at 317-232-2154.

Monday through Friday, 8 a.m. - 4:30 p.m., EST.

For more information regarding the repeal of inheritance tax, view the letter the Indiana Department of Revenue issued here, inheritance.pdf.

Indiana Department of Revenue

Re: Inheritance Tax Division

P.O. Box 71

Indianapolis, IN 46206-0071

Forms

Please take note of the instructions regarding the forms below:

- Blank forms may be downloaded.

- Fillable PDFs will not save as populated under the "save" option. Once filled, they may be printed to a PDF under the "print" option.

- Fillable forms are to be printed, signed, and submitted to the Assessor's office.

- For guidance on completing a Sales Disclosure, check out this comprehensive tutorial.

Forms

Please take note of the instructions regarding the forms below:

- Blank forms may be downloaded.

- Fillable PDFs will not save as populated under the "save" option. Once filled, they may be printed to a PDF under the "print" option.

- Fillable forms are to be printed, signed, and submitted to the Assessor's office.

- For guidance on completing a Sales Disclosure, check out this comprehensive tutorial.

Property Tax Cap Allocations

Indiana property tax caps limit the amount of property taxes to 1% of property values for homesteads (owner-occupied), 2% for other residential property and farmland, and 3% for all other property.- Homestead 1%

- Residential property 2%

- Long-term care property 2%

- Agricultural land 2%

- Nonresidential property 3%

- Business Personal Property 3%

Note: An individual real estate assessment may contain a variety of cap allocations.

Note: Property taxes imposed after being approved by the voters in a referendum or local public question shall not be considered for purposes of calculating a person’s credit ( i.e. Circuit Breaker Tax Credit). In other words, the voter-approved taxes are outside the property tax caps.

Note: A person does not need to file an application for the Property Tax Cap credit. It will automatically be applied to the property tax statement. This credit has nothing to do with the Homestead deduction. A taxpayer desiring to have a Homestead deduction must have an approved Homestead deduction on file in the Auditor’s office.

Homestead- 1%

- Consists of dwelling, garage, 1 acre of land

- Any number of decks, patios, gazebos, or pools.

- One (1) additional building that is not part of the dwelling if the building is predominantly used for a residential purpose and is not used as an investment property or as a rental property.

- One (1) additional residential yard structure other than a deck, patio, gazebo, or pool.”

- Has a homestead deduction on file

Residential Property- 2%

- Single-family dwelling that is not part of a homestead and 1 acre of land

- A building that includes 2 or more dwelling units (includes apartment buildings)

- Any common areas shared by the dwelling units, including land that is a common area

- Land on which the building is located

- Land rented or leased for the placement of a manufactured home or mobile home, including common areas shared by the manufactured homes or mobile homes

Long-Term Care- 2%

- Used for the long-term care of an impaired individual

- Health facility licensed under Indiana Code, or housing allowed to use the term “assisted living”

- Independent-living home that, under contractual agreement, serves not more than 8 individuals

Agricultural Land- 2%

- Land assessed as agricultural land under the real property assessment rules and guidelines of the Department of Local Government Finance

Nonresidential Property- 3%

- Real property that is not a homestead, or residential property

- Commercial land and improvements not considered Residential Property

- Yard improvements not part of a homestead

- Agricultural Improvements

Business Personal Property- 3%

Property Tax Cap Allocations

Indiana property tax caps limit the amount of property taxes to 1% of property values for homesteads (owner-occupied), 2% for other residential property and farmland, and 3% for all other property.- Homestead 1%

- Residential property 2%

- Long-term care property 2%

- Agricultural land 2%

- Nonresidential property 3%

- Business Personal Property 3%

Note: An individual real estate assessment may contain a variety of cap allocations.

Note: Property taxes imposed after being approved by the voters in a referendum or local public question shall not be considered for purposes of calculating a person’s credit ( i.e. Circuit Breaker Tax Credit). In other words, the voter-approved taxes are outside the property tax caps.

Note: A person does not need to file an application for the Property Tax Cap credit. It will automatically be applied to the property tax statement. This credit has nothing to do with the Homestead deduction. A taxpayer desiring to have a Homestead deduction must have an approved Homestead deduction on file in the Auditor’s office.

Homestead- 1%

- Consists of dwelling, garage, 1 acre of land

- Any number of decks, patios, gazebos, or pools.

- One (1) additional building that is not part of the dwelling if the building is predominantly used for a residential purpose and is not used as an investment property or as a rental property.

- One (1) additional residential yard structure other than a deck, patio, gazebo, or pool.”

- Has a homestead deduction on file

Residential Property- 2%

- Single-family dwelling that is not part of a homestead and 1 acre of land

- A building that includes 2 or more dwelling units (includes apartment buildings)

- Any common areas shared by the dwelling units, including land that is a common area

- Land on which the building is located

- Land rented or leased for the placement of a manufactured home or mobile home, including common areas shared by the manufactured homes or mobile homes

Long-Term Care- 2%

- Used for the long-term care of an impaired individual

- Health facility licensed under Indiana Code, or housing allowed to use the term “assisted living”

- Independent-living home that, under contractual agreement, serves not more than 8 individuals

Agricultural Land- 2%

- Land assessed as agricultural land under the real property assessment rules and guidelines of the Department of Local Government Finance

Nonresidential Property- 3%

- Real property that is not a homestead, or residential property

- Commercial land and improvements not considered Residential Property

- Yard improvements not part of a homestead

- Agricultural Improvements

Business Personal Property- 3%

Tax Bill Estimator

The Department of Local Government Finance (DLGF), in partnership with the Indiana Business Research Center (IBRC) at Indiana University, created the below tax bill projection tools for Indiana taxpayers. These tools will allow the taxpayer to enter their property's assessed value and possible deductions to see a range of tax bill estimates.

The estimates provided by these tools are projections only and should not be taken as a statement of true tax liability.

For a list of Taxing Districts (Number/Name) by Township, please see this listing made available by the DLGF.

Tax Bill Estimator

The Department of Local Government Finance (DLGF), in partnership with the Indiana Business Research Center (IBRC) at Indiana University, created the below tax bill projection tools for Indiana taxpayers. These tools will allow the taxpayer to enter their property's assessed value and possible deductions to see a range of tax bill estimates.

The estimates provided by these tools are projections only and should not be taken as a statement of true tax liability.

For a list of Taxing Districts (Number/Name) by Township, please see this listing made available by the DLGF.

General Questions

Where do I find my parcel number?

- On your Form 11

- On your property record card

- On your tax bill

- From the search bar on this website by entering your address

Where can I look up property record cards?

Property record cards can be searched, located, and printed online through a parcel search by clicking here.

Why does my assessment show a value for improvement when I haven't made any improvements to my property?

The term “Improvement” refers to your house, structure, or other improvements to the raw land. These are not necessarily improvements that have been added during the current year.

How do I find out who owns a property or how much it sold for?

- Use the search bar to search public information by address or parcel number

- You may also search by map using the Property Map

What is a Form 11? Will I get one?

Form 11 is an option for the Assessor and acts as a Notice of Assessment. Lake County does not currently issue Form 11s. Tax bills serve as the Notice of Assessment to all taxpayers.

Assessment Process

What is reassessment?

- A physical inspection of the property is performed to ensure records are accurate.

- Properties in Indiana are reassessed on a four‑year cycle, with one‑fourth of the county reassessed each year. For more information, visit the Department of Local Government Finance (DLGF) .

I bought my property at a tax sale. Why is my assessment higher than what I paid?

Real property in Indiana is assessed at Market Value in Use. Distress sales such as tax sales, foreclosures, or short sales are typically not representative of market value.

I paid more for my property than the assessed value. Will my taxes go up?

Assessed values fluctuate with the market. Valid sales provide important indications of market trends. An arm’s‑length sale is a significant factor in determining those trends and may affect future assessed values.

Where can I go for more information on the assessment process?

The Indiana Department of Local Government Finance (DLGF) offers extensive information regarding assessment procedures, current legislation, and tax policy: DLGF Assessment Overview .

What is a Ratio Study and how does it affect my assessed value?

Ratio studies are conducted to ensure uniformity and equity of assessments within a mass appraisal system. For more information, visit the DLGF Ratio Study page.

What is meant by Property Tax Caps?

Please see the first paragraph on the following webpage for an explanation of property tax caps: Tax Bill 101 .

Appeals

How can I check the status of my appeal?

Contact your County or Township Assessor for the status of active appeals. You may use the Contact Page.

How do I file an appeal if I disagree with my assessed value?

- A blank Form 130 can be accessed here: Blank Form 130

- Search your parcel using the search bar. Click on your address for property details. Under the Forms tab, you can access a Form 130 populated with your parcel information.

- Your appeal form may be mailed, brought to the Assessor’s Office, or submitted through this website.

Taxes

Why are my taxes higher than my neighbor’s?

- Several factors affect taxes once a property is assessed, including deductions, tax caps, and applicable fees.

- Assessed values are determined using a variety of exterior and interior property features. Properties that appear similar may have different characteristics.

- For more information on property taxes, visit the DLGF – Citizen’s Guide to Property Tax .

Why did my taxes go up?

Assessed values reflect market conditions and are trended annually. Actual taxes may vary based on locally approved tax rates, referendums, or individual property circumstances.

General Questions

Where do I find my parcel number?

- On your Form 11

- On your property record card

- On your tax bill

- From the search bar on this website by entering your address

Where can I look up property record cards?

Property record cards can be searched, located, and printed online through a parcel search by clicking here.

Why does my assessment show a value for improvement when I haven't made any improvements to my property?

The term “Improvement” refers to your house, structure, or other improvements to the raw land. These are not necessarily improvements that have been added during the current year.

How do I find out who owns a property or how much it sold for?

- Use the search bar to search public information by address or parcel number

- You may also search by map using the Property Map

What is a Form 11? Will I get one?

Form 11 is an option for the Assessor and acts as a Notice of Assessment. Lake County does not currently issue Form 11s. Tax bills serve as the Notice of Assessment to all taxpayers.

Assessment Process

What is reassessment?

- A physical inspection of the property is performed to ensure records are accurate.

- Properties in Indiana are reassessed on a four‑year cycle, with one‑fourth of the county reassessed each year. For more information, visit the Department of Local Government Finance (DLGF) .

I bought my property at a tax sale. Why is my assessment higher than what I paid?

Real property in Indiana is assessed at Market Value in Use. Distress sales such as tax sales, foreclosures, or short sales are typically not representative of market value.

I paid more for my property than the assessed value. Will my taxes go up?

Assessed values fluctuate with the market. Valid sales provide important indications of market trends. An arm’s‑length sale is a significant factor in determining those trends and may affect future assessed values.

Where can I go for more information on the assessment process?

The Indiana Department of Local Government Finance (DLGF) offers extensive information regarding assessment procedures, current legislation, and tax policy: DLGF Assessment Overview .

What is a Ratio Study and how does it affect my assessed value?

Ratio studies are conducted to ensure uniformity and equity of assessments within a mass appraisal system. For more information, visit the DLGF Ratio Study page.

What is meant by Property Tax Caps?

Please see the first paragraph on the following webpage for an explanation of property tax caps: Tax Bill 101 .

Appeals

How can I check the status of my appeal?

Contact your County or Township Assessor for the status of active appeals. You may use the Contact Page.

How do I file an appeal if I disagree with my assessed value?

- A blank Form 130 can be accessed here: Blank Form 130

- Search your parcel using the search bar. Click on your address for property details. Under the Forms tab, you can access a Form 130 populated with your parcel information.

- Your appeal form may be mailed, brought to the Assessor’s Office, or submitted through this website.

Taxes

Why are my taxes higher than my neighbor’s?

- Several factors affect taxes once a property is assessed, including deductions, tax caps, and applicable fees.

- Assessed values are determined using a variety of exterior and interior property features. Properties that appear similar may have different characteristics.

- For more information on property taxes, visit the DLGF – Citizen’s Guide to Property Tax .

Why did my taxes go up?

Assessed values reflect market conditions and are trended annually. Actual taxes may vary based on locally approved tax rates, referendums, or individual property circumstances.